Minto Money Reviews: Interest Rates, Pros & Cons, Login Method, and More

-

by admin

- 47

Online payday and short-term loans are a great solution for financial emergencies like hospital bills, utility bills, home repairs, or owed taxes.

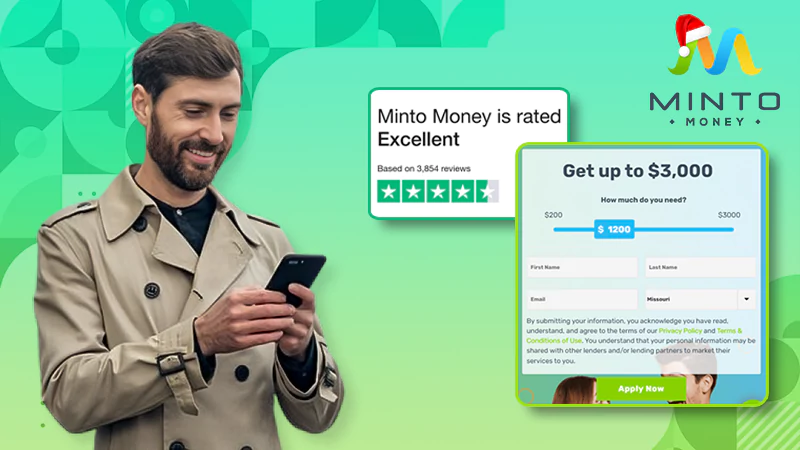

We are talking about one such company- Minto Money, which is owned by an American Indian Tribe. They are helpful to people who need cash right away.

However, there are many important things you need to know about the lender to make the right choices. So read the Minto Money reviews till the end to learn about the fundamentals and Minto money login process.

What is Minto Money?

Online tribal lender Minto Money provides small installment loans to borrowers in need of quick cash for unforeseen expenses. The lender is an American Indian tribe that is recognized as a sovereign by the federal government.

In terms of their short-term loan products, Minto Money complies with federal laws and regulations, in contrast to certain other tribal lenders.

Minto Money aims to simplify the lending process for customers as much as possible. They make an effort to achieve this through ethical lending methods and a dedication to the security and privacy of their clients. Thus, applying for a loan through Minto Money login portal is easy, and getting funding is decided upon quickly.

Now that you are introduced to the platform, let’s discuss its positives and negatives before looking at the specifics.

Mintomoney: Pros and Cons

Even though the platform helps during times of financial crunch, there are a few downsides as well. Let’s look at all the positives and negatives here.

| Pros | Cons |

|---|---|

| Fully online application process. | Hidden charges and rates. |

| Simple approval criterion. | Unclear information about repayment tenure. |

| Anyone with bad or no credit can qualify. | High interest rates for longer tenures. |

| The turnaround time is one day. | Not available in every state. |

| Does not charge early payments. | Loans are not available for active military officials. |

So these are the positives and negatives, according to the user reviews. Please note that opinions depend on personal experience; you can contact the company to learn more.

Minto Loans Specifics

Let’s discuss the Minto loan specifics here. Note that the data can change due to changes in fees and policies, so make sure to stay updated.

- 530% APR on average (although this can change depending on the loan amount and term).

- $100 to $2,500 in principal balances for new borrowers.

- For returning customers who have successfully repaid their previous loan, loans up to $3,000 are available.

- Terms can vary, but they typically last 10 months and require monthly payments.

- There are no upfront costs.

- For payments that are more than five days late, there will be a $20 late fee and an additional $30 interest charge.

- You can cancel the loan request by the following business day at 4:00 PM Central Time.

These are the general specifications of the loans by this platform.

Minto Money Personal Loan Details

These are some details you must know about personal loans.

- Minto Money does not accept loan applications from every state. Check out the list of states eligible to apply for loans.

- When submitting an online application, a question about being an active-duty military member appears at the bottom of the form. If you select Yes, you’ll be informed that you are not currently eligible for any credits. This is because the platform does not lend itself to active military personnel.

- Your bank may allow you to get your money the same day if your application is accepted by 2:00 p.m. Central Time, Monday through Friday.

- The platform has not mentioned the APR, interest rates, and other fees. So make sure to know the details before applying.

If you are interested in borrowing money after reading all the pros, cons, and specifics, proceed to the next section.

How to Apply for Mintomoney?

If you are in urgent need of money, you can apply for a loan online. All you need to do is, fill out the form and documents, and sign it electronically. But before that, you must fulfill the requirements to become eligible to apply for the loans.

These are the eligibility requirements every applicant has to fulfill for the tribal loans:

- The applicant must be 18 years or older.

- You must not be in the case of bankruptcy.

- The customer must have a checking account.

- You must be ready to provide personal, occupational, and valid account details.

Once you meet the requirements and are dedicated to borrowing money, follow the steps listed below to apply:

- First, go to the official Minto money.com and set the slider to the amount you wish to borrow.

- Enter the following info in the given field:

- First name

- Last name

- Email address

- Select your State from the drop-down menu.

- Click on the Apply Now button.

- You’ll be redirected to a new page. Here, enter the following info:

- Loan amount

- Address

- ZIP Code

- City

- State

- Tick on Yes or No for: Are you an active member of the military or the spouse or dependent of an active member of the military?

- Tap on Next, and you’ll be redirected to a new page.

Now, enter your occupation’s details and verify your identity to complete the process.

Once this is done, your form will be submitted. The company will send you mail regarding the application status.

How to Do Minto Money Login?

All the new borrowers and existing customers can go to their dashboard to view their payment dates and manage the money. These are the steps you need to follow for Minto Money login:

- First, go to the official portal.

- Click on the Member Login button on the homepage.

- Now, enter your email address and password or the last four of your SSN, in the given field.

- Tap the log-in button to enter your dashboard.

That’s it, you will be logged in to your account where you can manage your finances.

Other Products by Minto Money

The tribal loan company offers many financial services aside from personal loans. Let’s take a look:

- Advance of Credit Cards

- Loans for small businesses

- Equity credit line

- Existing savings and borrowing

These are a few other options you get with Mintomoney. To know about each of them in detail, you must contact the company representative.

Is Minto Money Legit?

Yes, it is a legitimate platform. They have lent money to thousands of people. We understand the concern given the fact multiple loan scams are circulating on the internet.

However, Minto Money is governed solely by the federal laws of the United States of America and the laws of the Indian reservation it is located on. It is owned and operated on a federally recognized Indian tribal reservation.

Who is the Right Candidate for a Minto Money Loan?

Well, these loans are not suitable for everyone. If you are someone who needs to cover expenses and is fine with high charges, then you can go with the platform.

In case, you are not in a position to pay high interest rates or need more than $3000, this platform is not the right option for you.

Talking about security and policies, the platform is trustworthy and reliable. It takes full responsibility for maintaining a secure financial environment for the customers.

Minto Money Reviews: What Do Customers Have to Say?

Minto Money is one of the go-to platforms for people to borrow money. 78% of customers have rated 5 stars on Trustpilot. Here is what they have to say:

The negative reviews of the platform generally point out its high APR, hidden charges, and verification process.

Customer Support Info.

The company has a dedicated team of experts who strive to solve customers’ issues. So, whether you want to know more about the fees or need assistance in the application process, reach out to the customer support team.

| Minto Money phone number | (844)446-4686 |

| Office Address | PO BOX 58112Minto, AK 99758 |

| Timings | Monday to Friday (7 AM to 7 PM) Saturday (8 AM to 4:30 PM) |

So this was all about the tribal loan platform. We hope this Minto Money review has cleared your doubts and will help you make the right financial decision. Please make sure to read all the terms and conditions and learn about the charges before committing to the platform.

Frequently Asked Questions

Ans: Due to its high-interest rates and other charges, if unable to repay on time, the amount stacks up quickly.

Ans: Yes, the platform is licensed as a financial services company.

Ans:

- The applicant must be 18 years old.

- Should not have a history of bankruptcy.

- Willing to share personal, and occupational details.

Sources:

Online payday and short-term loans are a great solution for financial emergencies like hospital bills, utility bills, home repairs, or owed taxes. We are talking about one such company- Minto Money, which is owned by an American Indian Tribe. They are helpful to people who need cash right away. However, there are many important things…

Online payday and short-term loans are a great solution for financial emergencies like hospital bills, utility bills, home repairs, or owed taxes. We are talking about one such company- Minto Money, which is owned by an American Indian Tribe. They are helpful to people who need cash right away. However, there are many important things…