IKEA Credit Card: Get Cashback Up to 5% and Other Benefits

Key Points:

- IKEA Credit Cards are store cards offered by IKEA in association with Comenity Bank.

- Annual Fee: $0

- Foreign Purchase Transaction Fee: $0

- Regular APR: 21.99% variable

- Balance Transfer APR: 26.99%

- Benefits: Fraud liability protection, up to 5% cash back, welcome bonus, and more.

Who doesn’t love buying new stylish furniture and home decor from IKEA? So why not save some dollars and get extra benefits per purchase? IKEA offers two credit cards to the consumers:

IKEA Visa credit card – For everyday purchases

IKEA Projekt credit card – For bigger purchases

These credit cards come with a $0 annual fee and offer tons of outstanding features. In this blog, we have covered the nitty-gritty of IKEA visa credit cards. So read till the end for a better understanding of this card.

IKEA Credit Card – Overview

IKEA – The biggest multinational conglomerate that designs and sells ready-to-assemble furniture, kitchenware, and home utility items, offers Comenity IKEA Visa cards that Comenity Finance Bank issues.

These cards are specially designed for loyal customers to get cash back, reward points, and other benefits on every transaction. The best thing is that the benefits are not limited to IKEA stores. Customers get equal cashback while shopping at Traemand and TaskRabbit as well.

What’s even better? It does not have any annual maintenance charges. Now that you’re introduced to the store card, let’s go ahead and learn more about it in detail.

IKEA Visa Credit Card: Pros and Cons

The store card comes with a handful of benefits that members can enjoy, however, there are some negative points that you must be aware of. Let’s discuss all the positives and negatives here:

| Pros | Cons |

| No annual fees. | Can only be used in IKEA stores. |

| Welcome bonus on signing up. | Rewards are limited to the brand. |

| No foreign transaction fee. | No intro APR for new cardholders. |

| Rewards and cash backs in different categories. | Charges balance transfer fee. |

| Fraud liability protection. | The reward points can expire. |

With the table above, you can get a clear picture of whether you want to go with this card or not. In the following section, we will talk about the features that IKEA cards have to offer.

Also Read: How to Accept Credit Card Payments for Business?

IKEA Comenity Credit Card: Features

The hallmark benefit of the IKEA Visa card is the rewards and cash back it offers on purchases. Not just that, there are many other note-worthy features you can get, let’s discuss them here.

Rewards

The company gives 5% cash back with IKEA purchases, Traemand installation services, and TaskRabbit Assembly services. 3% return on dining, grocery store, and utility purchases. 1% return on all other purchases.

You get Reward Dollars and Rewards Certificates which can be redeemed. Note that Rewards Dollars have 36 months expiry time and Certificates expire after 90 days of issue. Once you accrue $15 in rewards points, it automatically gets redeemed in your account.

If you accrue $44, you will be issued two certificates of $15 each, and $14 will be left in your rewards wallet for it to reach $15. If an account is closed and expires, any unused rewards will be forfeited.

Visa Card Benefits

The card offers all the Visa-network benefits. These include ID Navigator identity theft protection, enrollment services, lost or stolen card assistance, and cardholder inquiry services.

Fraud Liability Protection

With this feature by your side, you can use your card without any worry. The company does not charge for unauthorized transactions that are not done by the cardholder. You are only liable to pay for the transactions you have made.

Welcome Bonus

New cardholders can earn a $25 bonus upon spending $500 or more outside of Ikea, Traemand, and TaskRabbit within the first 90 days.

These are the outstanding features you get with these store cards. If the features it offers impress you and you want to get the card, make sure you are aware of the fees and additional charges.

IKEA Credit Card: Fees and Other Charges

As already stated these cards come with $0 annual fees. It’s still important to know about other charges, as they will all matter when you start using the card regularly.

Annual Fee: $0

Balance Transfer Fee: $10 or 5% of the sum, whichever is greater.

Foreign Purchase Transaction Fee: $0

Regular APR: 21.99% variable

Balance Transfer APR: 21.99%

Purchase Intro APR: 26.99%

These are the fundamentals that you have to keep in mind. Please note that to get IKEA cards, you first have to enroll and become an IKEA family member. After that, you can apply for a new card online or by visiting any branch.

How to Make IKEA Credit Card Payment?

The whole purpose of getting a credit card is saving money via cash back and rewards, but the bigger aim is to build a good credit history. As the company reports to major credit bureaus, it is important to pay the bills, which as a result will improve your FICO score.

Here are the following ways to pay IKEA credit card bills:

In-Store

Customers can visit any store branch and ask the cashier to help with the bill payment. Handover your card to proceed with the process. You can pay through Apple Pay, Samsung Pay, Google Pay, major credit cards, and cash.

Online

Another IKEA bill pay method is through the official site. Customers can log in to the personal dashboard with account credentials. There, in the Payment section, choose the mode of payment and follow the prompts to complete the process.

Mobile App

This is the most convenient method for an IKEA pay bill. If you have an official mobile application, follow the steps below:

- First, launch the app on your device.

- Fill in your account credentials to log in.

- Navigate to the Payment section in your dashboard.

- Here, view the amount to pay, and decide the payment mode.

- Follow the on-screen instructions to complete the IKEA bill pay process.

These are the methods to make IKEA credit card payments easily every month.

How to Complete the IKEA Visa Login?

The best part about Comenity-issued IKEA cards, Destiny credit cards, and Walmart Money Cards is that they offer a personal account to each member. One can manage their card activities, check the statements, put spending caps, and do so much more.

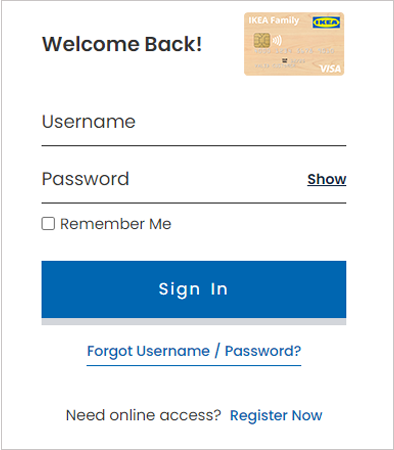

Here is how you can do an IKEA Visa login:

- First, go to the official site on your device.

- On the homepage, tap on the Sign in button.

- Enter your username and password in the given field.

- Lastly, click on the Sign in button, and you’ll be redirected to your dashboard.

So these are the simple steps to log in to the Comenity Bank IKEA portal. Moving ahead, let’s discuss who should and shouldn’t get this credit card.

Who Should and Shouldn’t Get an IKEA Credit Card?

These cards are best for people who frequently shop at the brand. Whether you wish to buy exquisite carpets or home improvement utilities, having the store card will help you get discounts and exclusive benefits.

However, if you do not make regular purchases at Ikea, this card might not be the best choice for you. You can find many other cards in the market that offer more benefits and have high reward redemption rates.

For better alternatives, you can also check out our list of 10 essential credit cards with no credit check to pick the right one for you. We sincerely hope this article was helpful to you.

Read Next: Credit card size: Thickness, weight, material, and more

Frequently Asked Questions

Ans: Yes, the store accepts all major credit cards.

Ans: You must check if there are any spending caps or other limitations on your credit card.

Ans: It can be hard to qualify for this card if you do not have a fair CIBIL score.

Sources: